As Microsoft, Alphabet, Meta, Amazon, and Oracle unveil new capital spending plans, investors brace for a reality check on the AI-driven stock market rally. With Nvidia nearing a $5 trillion valuation, Wall Street watches whether tech giants can sustain confidence in artificial intelligence investments.

Introduction: AI Spending in Focus as Markets Hit Record Highs

The global stock market is once again holding its breath as Wall Street’s largest technology companies prepare to release fresh earnings and capital spending updates. This week’s reports from Microsoft, Alphabet, Meta, and Amazon could determine whether the AI-fueled stock rally that has propelled U.S. markets to record highs will continue — or start to cool.

Artificial intelligence, once a futuristic concept, has become the defining investment theme of the decade. Since the launch of ChatGPT in November 2022, the AI boom has sparked a massive wave of optimism, transforming how companies spend, innovate, and compete.

But with the S&P 500 up 17% year-to-date and nearly 90% since the bull market began three years ago, investors are asking a critical question: Can AI spending remain sustainable — or is Wall Street repeating the mistakes of the dot-com era?

The AI Trade: How Capital Spending Became Wall Street’s Barometer

The Rise of the Hyperscalers

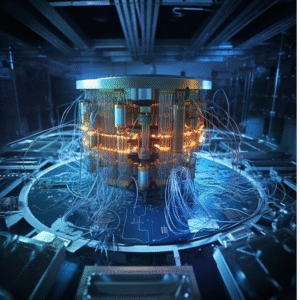

The AI revolution is being powered — quite literally — by the world’s biggest “hyperscalers”: Microsoft, Alphabet, Meta, Amazon, and Oracle. These companies have invested heavily in data centers, semiconductor infrastructure, and high-performance computing to support AI training models and digital platforms.

According to Barclays equity strategists, combined capital expenditures (capex) by these five giants doubled between 2022 and 2024, surpassing $200 billion. That figure is projected to soar to nearly $500 billion by 2027, underscoring the extraordinary scale of the ongoing AI buildout.

Why Investors Are Watching Capex

For investors, these capex figures have become the ultimate measure of conviction in the AI trade. When companies expand spending on AI data centers, chips, and servers, it signals long-term confidence in the technology’s transformative potential.

“You want to still see that they are investing in these AI data centers and still continuing to build,” said Don Nesbitt, Senior Portfolio Manager at F/m Investments. “If you start to see them falter, that’s a bellwether for the whole AI theme.”

This week’s earnings — with Microsoft, Alphabet, and Meta reporting on Wednesday and Amazon following on Thursday — are expected to serve as a crucial reality check.

The Market Context: Nvidia and the Symbolism of $5 Trillion

Nvidia: The Face of the AI Mania

No company better captures the current AI enthusiasm than Nvidia (NVDA). The semiconductor giant’s powerful graphics processing units (GPUs) have become the backbone of AI infrastructure globally.

Nvidia’s stock has soared to the point where it is now the world’s most valuable company, closing in on an unprecedented $5 trillion market capitalization — a milestone that would have seemed unthinkable just two years ago.

The company’s growth has made it a symbol of both innovation and speculation, reminding many investors of the euphoria that surrounded tech companies during the late 1990s dot-com boom.

AI Versus the Dot-Com Bubble: Similarities and Differences

Comparisons to the dot-com bubble are inevitable. Like the internet mania of 25 years ago, today’s market is driven by optimism about a revolutionary technology with world-changing potential.

However, analysts argue that this time might be different — at least for now. The key distinction is that today’s AI leaders have real revenue, cash flow, and profitable business models. In contrast, many dot-com startups of the 1990s were speculative ventures with little to no earnings.

Still, history offers a warning: unchecked enthusiasm, rapid spending, and unrealistic growth assumptions can quickly lead to overcapacity and painful corrections.

Big Tech’s Capex Race: Building the Future or Overbuilding the Dream?

Capex Expansion Hits Record Levels

The numbers are staggering. Collectively, the top five AI hyperscalers are now spending around 60% of their operating cash flow on capital expenditures — the highest level ever recorded, according to Torsten Slok, Chief Economist at Apollo Global Management.

These investments fund everything from cloud data centers to advanced networking systems and AI chip infrastructure. While this wave of spending drives short-term growth and technological innovation, it also raises concerns about potential overinvestment and market saturation.

The Risk of Overcapacity

Some analysts warn that, like the fiber-optic boom of the 1990s, this spending spree could create an oversupply of infrastructure if demand for AI applications doesn’t scale as rapidly as expected.

“The key to determining whether this might be a bubble probably sits with the same sign we got in the late ’90s — wasteful capital spending,” said Jeff Buchbinder, Chief Equity Strategist at LPL Financial.

If companies build too much capacity too quickly, the market could face years of underutilized resources — echoing the telecom bust that followed the dot-com bubble.

Why Wall Street Still Wants to See More Spending

Investor Sentiment: Confidence Equals Commitment

Despite the risks, investors are not calling for restraint — quite the opposite. On Wall Street, continued AI spending is seen as a vote of confidence in the technology’s profitability and long-term viability.

“If the hyperscalers pared back their spending, it’s then signaling that they may not believe in the monetizable potential of these technologies,” said Nick Giorgi, Chief Equity Strategist at Alpine Macro.

In essence, investors view heavy capex as a bullish signal. Scaling AI infrastructure not only fuels innovation but also reinforces the narrative that these firms are investing for a trillion-dollar opportunity that could reshape entire industries.

The Return-on-Investment Question

Still, analysts and shareholders alike will be dissecting the upcoming quarterly reports for more than just spending figures. They want to understand the expected returns — when and how these investments will start to pay off.

Key questions include:

- Are AI products driving meaningful revenue growth?

- How much of the spending is translating into new demand for cloud services?

- Are profit margins holding up despite rising costs?

Comparing Today’s AI Spending to Past Booms

Lessons from the Telecom Buildout

Investment firm Glenmede drew parallels between today’s AI investment wave and the telecom infrastructure boom of the 1990s. Back then, telecom companies poured billions into fiber-optic networks, anticipating an explosion in internet demand that largely failed to materialize in the short term.

In contrast, Glenmede notes that today’s AI “hyperscalers” enjoy stronger financial health and profitability. Free cash flow margins for AI leaders currently average 15%, compared to just 3.5% for telecom firms during the dot-com bubble.

This resilience provides a safety buffer, suggesting that even if AI spending slows, these companies are unlikely to face the same level of financial strain.

The Shift from “Asset-Light” to “Asset-Heavy”

For much of the past two decades, Wall Street rewarded “asset-light” companies — firms that scaled through software and services without heavy capital costs.

But as AI infrastructure becomes essential, that mindset is shifting. “The script has flipped,” said Michael Reynolds, Vice President of Investment Strategy at Glenmede. “Companies deploying capex at large scale are now outperforming to a significant degree.”

The reason is simple: in the AI era, those who build the digital foundation — data centers, chips, and cloud networks — hold the keys to the future economy.

The Bull Case: Why AI Spending Could Be Justified

Unprecedented Market Opportunity

Proponents argue that AI isn’t a short-term tech trend but a paradigm shift comparable to the industrial or internet revolutions. From autonomous systems to generative tools and enterprise automation, the applications are vast.

Market research firms estimate that the global AI industry could surpass $1 trillion in annual revenue by 2030. For Big Tech, capturing even a fraction of that opportunity justifies the current spending spree.

The Productivity Dividend

Advocates also point to the potential for AI to boost productivity across every sector — from manufacturing and healthcare to education and finance. As businesses adopt AI to automate workflows and analyze data, the broader economy could benefit from higher efficiency and innovation.

This long-term payoff, investors say, validates the near-term cost.

The Bear Case: Signs of Overvaluation and Saturation Risks

Rising Valuations, Shrinking Margins?

Skeptics warn that the AI rally may be overextended. The S&P 500’s tech sector now trades at historically high valuation multiples, with many AI-linked stocks pricing in years of future growth that may not materialize.

While most hyperscalers remain profitable, the rising cost of infrastructure and competition for chip supplies could pressure margins in coming quarters. Investors fear that slowing AI adoption rates or weaker enterprise demand could lead to disappointment.

A Fragile Balance Between Optimism and Reality

The challenge for Big Tech is to maintain a delicate balance: demonstrating continued innovation without triggering fears of overreach. If any of the major players signal a pullback in spending or weaker demand, it could send shockwaves through the market.

In that sense, this week’s earnings updates are about more than profits — they are a referendum on the future of the AI economy itself.

Broader Economic Implications

From Wall Street to Main Street

The AI investment boom extends beyond technology companies. Semiconductor manufacturers, power suppliers, and construction firms building massive data centers are all benefiting from the ripple effects.

However, the rapid pace of AI expansion also raises macroeconomic concerns — from energy consumption to labor displacement. Analysts warn that as companies scale up AI operations, power demand and infrastructure pressure could become significant economic variables.

Regulatory and Ethical Considerations

Governments around the world are racing to catch up with the implications of AI growth. From data privacy to algorithmic accountability, policymakers are grappling with how to regulate a technology evolving faster than legislation can adapt.

As the industry matures, the success of AI investments will depend not just on innovation but on building trust, transparency, and ethical governance into the ecosystem.

Conclusion: The Moment of Truth for AI and the Markets

The coming week could prove pivotal for the AI stock market narrative. As Microsoft, Alphabet, Meta, and Amazon unveil their spending updates, investors will look for validation that the world’s biggest companies still believe in — and can profit from — the AI revolution.

For now, Wall Street remains captivated by the promise of artificial intelligence. The capital flows, corporate ambition, and soaring valuations suggest unshaken confidence in the technology’s potential.

But history reminds us that even the brightest innovations must eventually justify their price tags. Whether this era becomes remembered as the dawn of a new technological age or another speculative bubble will depend on what happens next.

Suggested Internal Linking for SEO

- Related Article: “Nvidia’s $5 Trillion Dream: Can AI Chips Keep Up with Market Hype?”

- Related Article: “How Big Tech’s Cloud Spending Is Shaping the Future of AI Infrastructure”

- Related Article: “AI Regulation: Balancing Innovation with Accountability”